does instacart take taxes out of your check

Then if your state taxes personal income youll need to find out the tax rate for your state and. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s.

Does Instacart Take Out Taxes In 2022 Full Guide

Knowing how much to pay is just the first step.

. No taxes are taken out. Plan ahead to avoid a surprise tax bill when tax season comes. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a.

Instacart delivery starts at 399 for same-day orders over 35. This is an Independent Contractor position. Then you will enter your expenses.

Like all other taxpayers youll need to file Form 1040. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers.

There will be a clear indication of the delivery. Download the Instacart app or start shopping online now with Instacart to get. Instacart does not take out taxes for independent contractors.

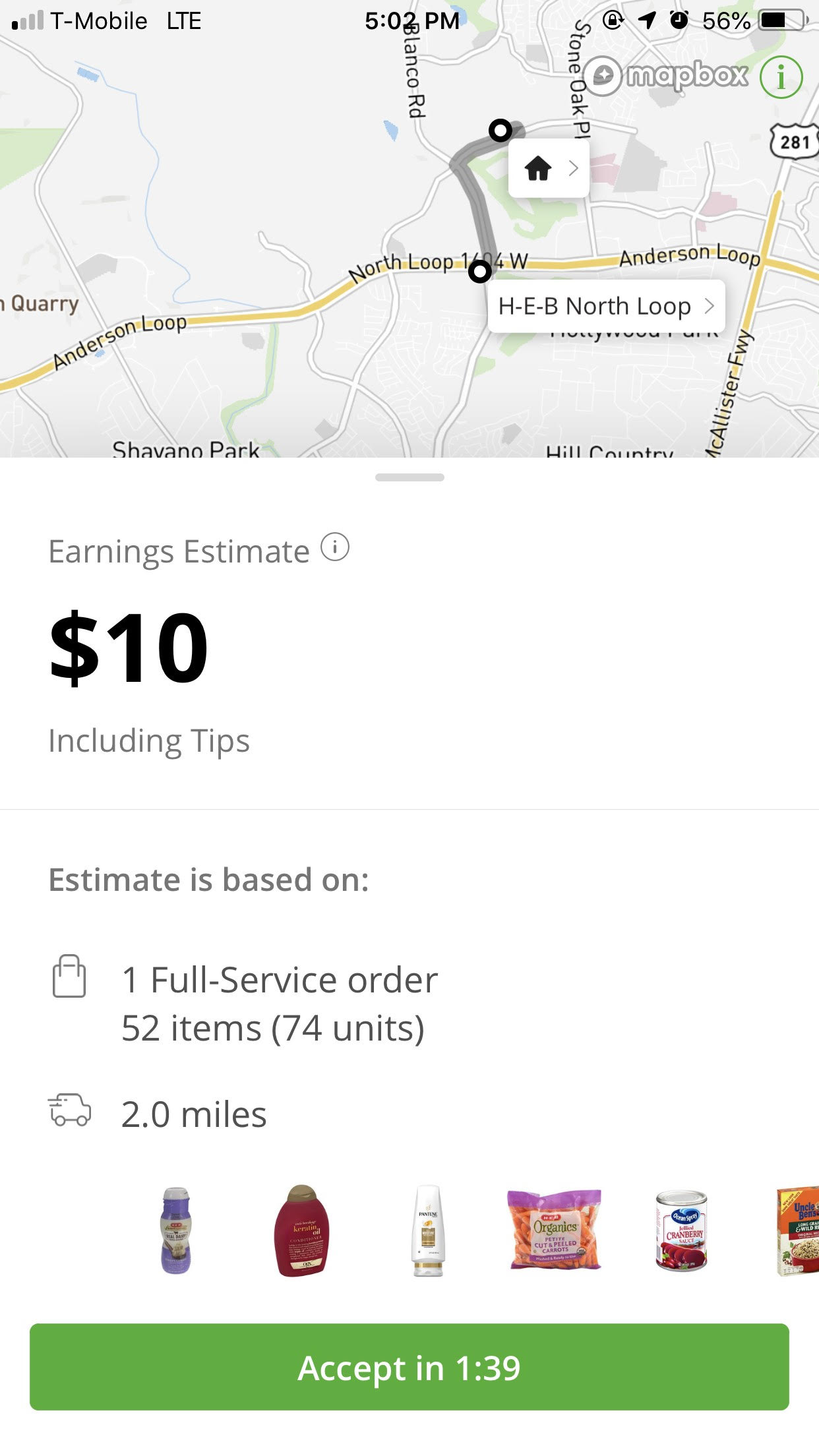

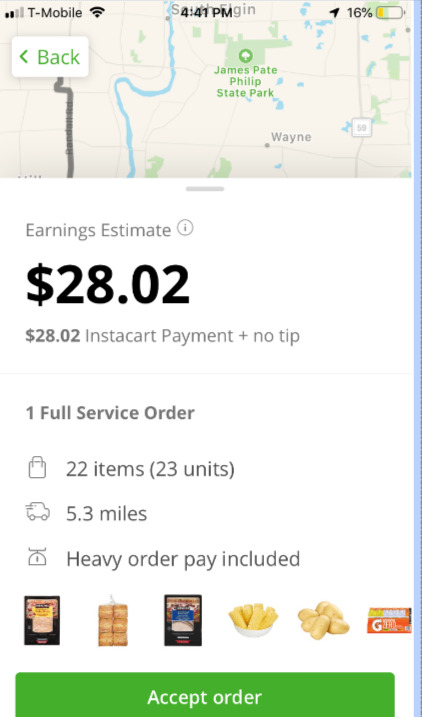

You do get to take off the 50 ER. What Taxes Do Instacart Shoppers Need to Pay. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the.

Self Employment tax Scheduled SE is automatically generated if a person has. They will owe both income and self. Heres how it works.

You will be given a 1099 misc at tax time and you will pay taxes on everything you earned. Instacart 1099 Tax Forms Youll Need to File. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Instacarts official name is Instacart other delivery companies use different legal names. Then if your state taxes personal income youll. FICA contributions are shared between the employee and the employer.

This tax form summarizes your income for the year deductions and tax. You can find this in your shopper account or keep records in your own bookkeeping app. Heres how it works.

To actually file your Instacart taxes youll need the right tax form. Instacart Is Fixing One Of The Most Controversial Parts Of Its Grocery Delivery Service If you dont have direct deposit set up they will mail you a check. If you make more than 600 per tax year theyll send you a 1099-MISC tax form.

The Instacart 1099 tax forms youll need to file. The current rate for Medicare is 145 for the employer. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay.

Fees vary for one-hour deliveries club store deliveries and deliveries under 35. How much of my Social Security is taxable in 2021. Find answers to For In-Store shopper position does Instacart already take out taxes from your check or would you still have to file a 1099 form from Instacart employees.

FICA contributions are shared between the employee and the employer. You are paid all your money in full. Just go through the interview and answer the questions.

Instacart Changes How It Pays Shoppers But Many Say They Re Now Making Less Ars Technica

What You Need To Know About Instacart 1099 Taxes

How To Handle Your Instacart 1099 Taxes Like A Pro

Self Employment Taxes A Guide For Food Delivery Drivers

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Gig Workers Collective On Twitter Every Year Instacart Shoppers Calculate Their Earnings And Notice The 1099 Form Lists An Incorrect Amount Every Year Instacart Claims They Ll Look Into It But Never Follow

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery

How To Know Your Taxable Income As An Independent Contractor

Instacart Mising Information On My Tax Forms Check Yours Youtube

Doordash Taxes Does Doordash Take Out Taxes How They Work

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

Instacart Help Center Instacart Fees And Taxes

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

What You Need To Know About Instacart 1099 Taxes

What You Need To Know About Instacart Taxes Net Pay Advance

How Self Employment Tax Works For Delivery Drivers In The Gig Economy

Be An Instacart Shopper Instacart Shopper Pay And Instacart Driver Info